SBA and Treasury Announce PPP Re-Opening; Issue New Guidance (POSTED 1.08.2021)

The U.S. Small Business Administration, in consultation with the Treasury Department, announced today that the Paycheck Protection Program (PPP) will re-open the week of January 11 for new borrowers and certain existing PPP borrowers. To promote access to capital, initially only community financial institutions will be able to make First Draw PPP Loans on Monday, January 11, and Second Draw PPP Loans on Wednesday, January 13. The PPP will open to all participating lenders shortly thereafter. Updated PPP guidance outlining Program changes to enhance its effectiveness and accessibility was released on January 6 in accordance with the Economic Aid to Hard-Hit Small Businesses, Non-Profits, and Venues Act.

This round of the PPP continues to prioritize millions of Americans employed by small businesses by authorizing up to $284 billion toward job retention and certain other expenses through March 31, 2021, and by allowing certain existing PPP borrowers to apply for a Second Draw PPP Loan. “The historically successful Paycheck Protection Program served as an economic lifeline to millions of small businesses and their employees when they needed it most,” said SBA Administrator Jovita Carranza. “Today’s guidance builds on the success of the program and adapts to the changing needs of small business owners by providing targeted relief and a simpler forgiveness process to ensure their path to recovery.”

“The Paycheck Protection Program has successfully provided 5.2 million loans worth $525 billion to America’s small businesses, supporting more than 51 million jobs,” said Treasury Secretary Steven T. Mnuchin. “This updated guidance enhances the PPP’s targeted relief to small businesses most impacted by COVID-19. We are committed to implementing this round of PPP quickly to continue supporting American small businesses and their workers.”

Key PPP updates include:

• PPP borrowers can set their PPP loan’s covered period to be any length between 8 and 24 weeks to best meet their business needs;

• PPP loans will cover additional expenses, including operations expenditures, property damage costs, supplier costs, and worker protection expenditures;

• The Program’s eligibility is expanded to include 501(c)(6)s, housing cooperatives, destination marketing organizations, among other types of organizations;

• The PPP provides greater flexibility for seasonal employees;

• Certain existing PPP borrowers can request to modify their First Draw PPP Loan amount; and

• Certain existing PPP borrowers are now eligible to apply for a Second Draw PPP Loan.

A borrower is generally eligible for a Second Draw PPP Loan if the borrower:

• Previously received a First Draw PPP Loan and will or has used the full amount only for authorized uses;

• Has no more than 300 employees; and

• Can demonstrate at least a 25% reduction in gross receipts between comparable quarters in 2019 and 2020.

The new guidance released includes:

• PPP Guidance from SBA Administrator Carranza on Accessing Capital for Minority, Underserved, Veteran, and Women-owned Business Concerns;

• Interim Final Rule on Paycheck Protection Program as Amended by Economic Aid Act; and

• Interim Final Rule on Second Draw PPP Loans.

VISIT SBA.GOV/PPP

PPP (Paycheck Protection Program) Round 2 Highlight VIDEO (POSTED 12.30.2020)

Join Judd Wilson (VP Chamber of Commerce) and Matt McCarty (CFO) as they discuss the highlights of round two of the Paycheck Protection Program. FACEBOOK WEBINAR VIDEO

PPP (Paycheck Protection Program) has been extended until March 31, 2021 (POSTED 12.29.2020)

The Paycheck Protection Program has been extended a few more months. How can it benefit you? what has changed? Download the informative PDF at cdf.ms/ppp

WARNING: MISLEADING 2021 ANNUAL REPORT MAILER FROM C.F.S. (POSTED 11.13.2020)

The Secretary of State’s Office urges the business community, especially LLCs, to be cautious of a misleading mailer sent by a private entity called C.F.S. In the mailer, the company offers to prepare 2021 annual reports for a $75.00 fee. The mailer may appear to be official government correspondence, but the fine print makes it clear it is not. All business owners should be aware this correspondence is not authorized by the Mississippi Secretary of State’s Office.

READ MORE: cdf.ms/cfs

›››THE MISSISSIPPI RENTAL ASSISTANCE GRANT APPLICATION IS NOW ONLINE! (POSTED 10.28.2020)

The Mississippi Development Authority is accepting applications for grants to property owners to help them recover rental income lost between March 1, 2020, and December 30, 2020, due to COVID-19. Deadline to apply is November 15, 2020.

What is the Rental Assistance Grant Program?

On October 9, 2020, House Bill 1810 established the Rental Assistance Grant Program. The Program will be used to award grants to Mississippi Rental Businesses (i.e., owners/landlords) to assist them with Lost Rental Income resulting from the COVID-19 public health emergency and the attendant eviction moratoria imposed by the federal and state governments. The maximum amount of total grant monies available to an Eligible Rental Business is $30,000.

APPLY NOW:

www.mississippi.org/mrap

›››BACK TO BUSINESS MISSISSIPPI GRANT PROGRAM (UPDATED 9.19.2020)

››BACK TO BUSINESS MS GRANT UPDATE

[From the Mississippi Development Authority]

"This week, the Mississippi Development Authority will modify the program based on changes in the state law. Applicants DO NOT have to re-apply or make changes to their existing application. The three primary changes are:

1. The base payment will increase from $1,500 to $3,500.

2. If you received $2,000 from the Department of Revenue, it will NOT be deducted from your Back to Business grant.

3. The deadline to file an application is September 15, 2020.

If you have already received a payment from the program, you will get a supplemental check in the coming weeks. All future grant payments will reflect the new calculations.

We know many of you are still waiting to hear from us regarding the status of your application. We continue to receive applications, and we are working diligently to process and review them. Once it is reviewed, you will receive an email notifying you of the status.

Since the program began in June, more than 30,000 small business owners have registered, and over 3,000 checks have been mailed.

We know the COVID-19 pandemic has been difficult, and we appreciate your hard work, dedication and patience.

Please continue to check your email regularly, including spam and junk folders, for updates.

Thank you for choosing to invest in Mississippi."

››DOWNLOAD A FREE STEP BY STEP GUIDE

The Community Development Foundation has developed a free step by step guide in filling out the Back to Business Mississippi Grant application. Download your free PDF here: http://cdf.ms/guide

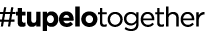

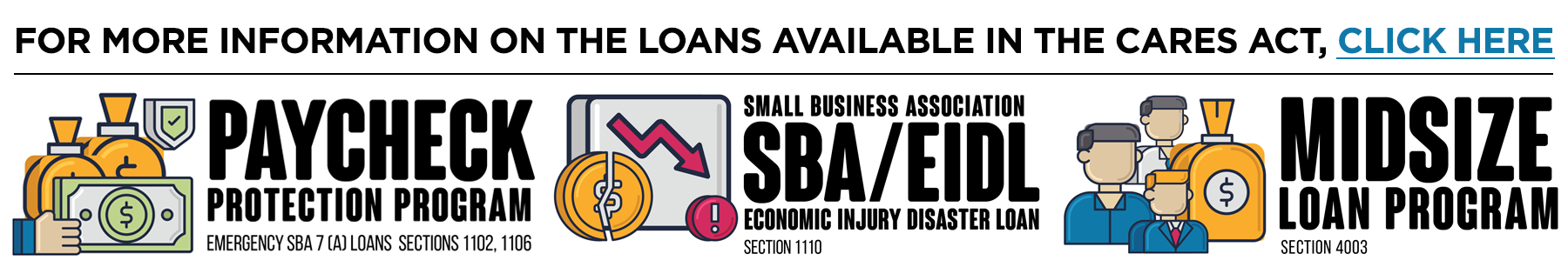

››DOWNLOAD A FLYER PROMOTING THE HELP CENTER JUNE 23-25

|

CLICK HERE to download a PDF flyer promoting the Help Center to be held at the BancorpSouth Arena June 23-25. The Help Center will be open to the public. Times and dates are:

Tuesday, June 23 from 9:00 a.m. to 7:00 p.m.

Wednesday, June 24 from 9:00 a.m. to 4:00 p.m.

Thursday, June 25 from 9:00 a.m. to 4:00 p.m.

|

››POSSIBLE DOCUMENTATION YOU MAY NEED TO APPLY

Documentation that you might need to complete your application online depends on the type of business and type of reimbursement expenses you are requesting. CLICK HERE to download a PDF explaining some possible documentation you may need and why.

››HELP CENTER TO BE HELD JUNE 23, 24 & 25 AT BANCORPSOUTH ARENA

"To help businesses navigate through the application process, the City of Tupelo and the Economic Recovery Task Force will offer free help though the Back to Business Help and Resource Center June 23-25 starting at 9 a.m. each day at the BancorpSouth Arena. The assistance, sponsored by the Lee County Supervisors, United Way, Three Rivers Planning and Development, CDF, CREATE Foundation and Itawamba Community College, will last until 7 p.m. on June 23 and until 4 p.m. June 24-25." FROM DJOURNAL.COM | READ MORE

The Paycheck Protection Program (PPP) from the U.S. Small Business Administration (SBA) was rolled out to provide critical support to countless businesses heavily affected by the COVID-19 pandemic. One aspect of the loan is especially enticing to borrowers: loan forgiveness. With many businesses now halfway through the eight-week period to spend their loan proceeds, the issue of properly calculating loan forgiveness amounts is of critical importance. Join BKD Trusted Advisors™ as we review these provisions to help you navigate the rules around this significant issue. Given the widespread impact of this program, we have also allotted extra time for a Q&A to help provide clarity around this complex topic. WATCH WEBINAR | PDF OF THE PRESENTATION | PPP LOAN FORGIVENESS ONE PAGER

On May 20, 2020, Governor Tate Reeves signed SB2772 into law, establishing the Back to Business Mississippi Grant Program. The grants will be used to help businesses in Mississippi with 50 or fewer employees recover from the economic impact of COVID-19, including operating expenses and salaries. The Mississippi Development Authority soon will begin accepting applications on this site from small businesses. Please check back frequently for updates or sign up below for email notifications. BACKTOBUSINESSMS.ORG

The Mississippi State Legislature passed the “2020 COVID MS Business Assistance Act” to provide economic support to eligible Mississippi businesses affected by COVID 19. The $300 million total package is divided into two parts, a $60 million program to provide $2,000 in direct payments to businesses forced to close by government orders; and a $240 million program ($40 million set aside for minority owned businesses) to provide up $25,000 in application grants.VIEW PDF

FROM MDES.MS.GOV - Mississippi Department of Employment Security announces that Mississippi workers who are not able to work due to COVID-19 will be eligible to file for unemployment benefits. These temporary measures will help relieve the financial hardship of temporary layoffs by making unemployment benefits available to individuals whose employment has been impacted by COVID-19. This helps not only individuals but also employers by helping them retain their workforce and stabilizing local economies.

READ MORE

FROM DJOURNAL.COM - Dennis Seid / "The latest bill provides $250 billion to replenish the Paycheck Protection Program, a fund to help small and medium-size businesses with payroll, rent and other expenses. Initially funded with $349 billion, money ran out within a week of its launch earlier this month. Experts expect this latest cash infusion to disappear quickly as well."READ MORE

Small businesses are the foundation of our communities and our economy. Employing nearly half the American workforce, companies like yours keep our neighborhoods running and make them feel like home. We know you’re facing multiple challenges right now, and every dollar counts. Funded by corporate and philanthropic partners, the Save Small Business Fund is a collective effort to provide $5,000 grants to as many small employers as we can. We hope these supplemental funds will help you get through the next days and weeks. SEE IF YOU QUALIFY